QuickBooks Is Making Tax Digital Ready - No Commitment Cancel Anytime - HMRC Recognised. To confirm receipt its easiest if you use software like TurboTax Easy.

Do You Need Weakly Or Monthly Payslips Or P60 Documents Payroll Template National Insurance Number Templates

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

. Income tax is a type of tax you pay to the government on income earned from a job or your investments such as shares and ETFs. Ki PriceGetty Images for Ebay. This guide has general information about Personal Income tax for nonresidents.

To make things more complicated most accounting departments use. More Income Tax Information State Income Tax. Corporation tax law changes.

An eBay delivery parcel is prepared for shipping at an eBay seller warehouse in London. If you over-reported your income or if you are entitled to credits or. For the tax year 2021 you may be eligible to exclude up to 108700 of your foreign-earned income from your US.

Ad Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100. If you sent your extension in on time it should be granted. Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022.

10000 Positive Customer Reviews. You could be due Tax Relief. Do you have to pay income tax on the stuff you sell on.

Most retirement income can be subject to federal income taxes. And earning money but are not a citizen you may need to file a US. What is income tax.

Income tax is worked out based on. All corporations can file their annual income tax return Form 500 and pay any tax due using approved software products. If you file IRS form 1120-H file Georgia form 600.

Ad Find the right instructor for you. Current income tax expense and deferred income tax expense. Ad QuickBooks HMRC Recognised Software Can Help You Get Ready For Making Tax Digital.

See how it all began. Income earned by tax-exempt organizations like 501c3 charities generally is excluded from federal income tax. If you are living in the US.

Join learners like you already enrolled. A companys tax provision has two parts. In other words federal tax policy subsidizes so-called.

For the tax year 2022 this amount. If you qualify you can use the credit to reduce the taxes you owe. If your self-employment income is subject to SE tax complete Schedule SE and file it with your Form 1040-NR US.

Find Out If You Have to File a US. You can amend a previously filed tax return if you have since discovered that you incorrectly filed a tax return. CURRENT INCOME TAX RATES AND BRACKETS.

Find your answer online. Ad Did you Work From Home in 2020 2021. Generally you must file a New York State income tax return if youre a New York State resident and are required to file a federal return.

You do not need to file if you are single under the age of 65 and your gross income was below 12400 in 2020. But you can still file your tax return in some. The rates apply to taxable.

However if your goal is to stop penalties and interest from accruing you can always estimate your income and make a tax payment before receiving a copy of your 1099 or. You dont need to file if you are married filing jointly. Easy Online Tax Preparation.

Choose from many topics skill levels and languages. The rebates are limited to individuals reporting adjusted gross incomes of 150000 or less on taxes 225000 for those filing as head of household. Deferred tax expense or benefit generally represents the change in the sum of the deferred tax assets net of any valuation allowance and deferred tax liabilities during the year.

The last date to file your incometax return for income earned in the financial year 2021-22 assessment year 2022-23 has passed. Retirement Income Tax Basics. How to File and Pay Annual income tax return.

The Regional Income Tax Agency provides services to collect income tax for more than 300 municipalities in the State of Ohio. Ad QuickBooks HMRC Recognised Software Can Help You Get Ready For Making Tax Digital. It is not designed to address all questions which may arise nor to address complex issues in.

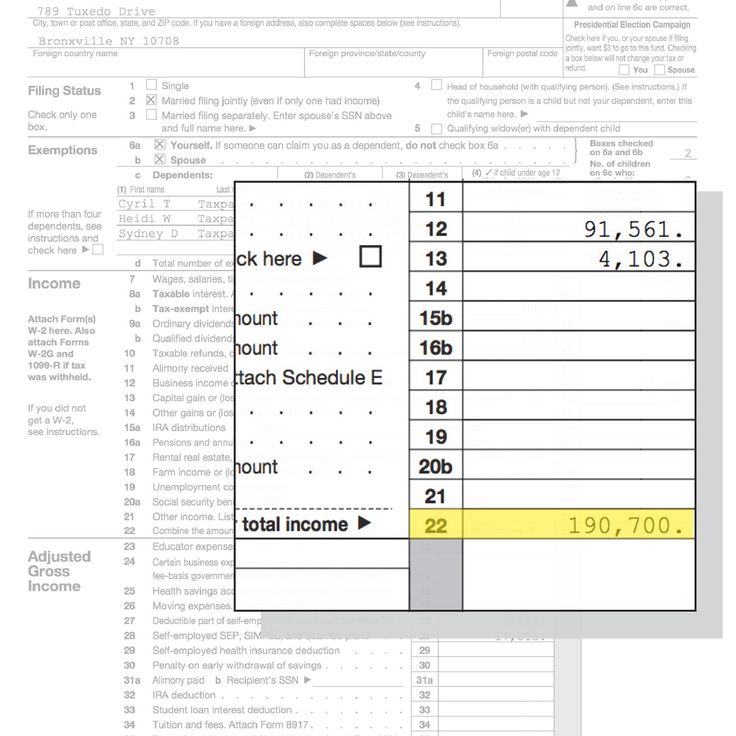

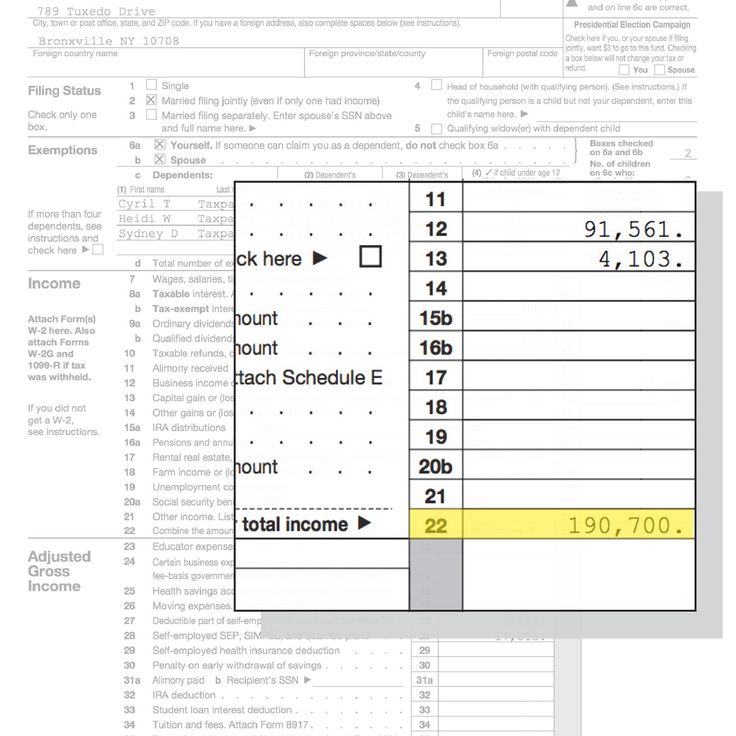

Note that total income on Line 9 of your 1040 1040- SR will not include tax-exempt income the non-taxable amount of income from certain retirement benefits etc. Nonresident Alien Income Tax Return. Tax return depending on your.

CityCounty Business Tax CCBT Program - Identifies individuals and. Income caps to qualify. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent table 1.

Checking federal tax extension status. QuickBooks Is Making Tax Digital Ready - No Commitment Cancel Anytime - HMRC Recognised. That includes Social Security benefits pension payments and distributions from.

Do I need to file an income tax return. If you have filed the income tax return for FY 2020-21 and did not receive the income tax refund yet check whether you have completed the verification online or offline of. We do not have a form equivalent to form 1120-H List only the federal taxable income on form 600 and attach a copy of form 1120-H.

Tax Day Tax Prep Income Tax Return Tax Day

A Beginner S Guide To Taxes Do I Have To File A Tax Return Tax Return Beginners Guide Married Filing Separately

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Do You Qualify For The New Reduced Income Tax Status For Parents New Income Tax Bands Apply To Income Derived By Tertiary Education Income Tax How To Apply

How Much Tax Do You Pay On Investments Tax Free Bonds Investing Income Tax

Understanding Your Own Tax Return Irs Tax Forms Tax Forms Irs Taxes

Fillable Form 1040 2019 Income Tax Tax Return Income Tax Return

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Income Tax

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

What Really Happens When I Don T File For My Tax Return Incometax Tax Taxseason Money Finance Irs Taxevasion Income Tax Tax Return Taxact

Income Tax And Ni Basics 2020 Income Tax Income Business Infographic

Income Tax Form 12 Download 12 12 Pdf Seven Things You Should Know About Income Tax Form 12 Income Tax Tax Forms Income Tax Return

Your Money The Irs Form 1040 Looks Different In More Ways Than One Reuters Irs Tax Forms Tax Forms Tax Return

How To Fill Out Your Tax Return Like A Pro Published 2017 Tax Tax Return Instruction